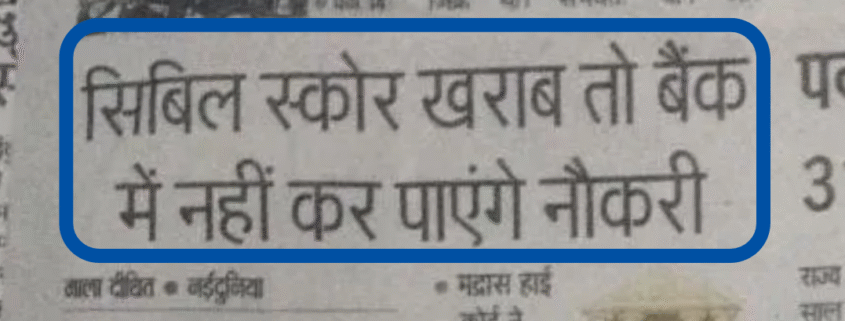

Banks can reject job applicants with poor CIBIL scores

New Delhi – In a landmark decision that could change the future of banking recruitment in India, the Delhi High Court has ruled that banks can reject job applicants with poor CIBIL scores, reinforcing the increasing importance of maintaining a clean financial record — not just for loan eligibility, but also for employment.

This news has sent ripples across the job market, especially among young aspirants preparing for public sector bank exams. With this decision, financial credibility is no longer just a loan criterion — it’s now a career gatekeeper.

The Incident: When a Job Offer Was Denied Due to Bad Credit

The case that triggered this legal validation involves a candidate who was selected for the Junior Associate post at the State Bank of India (SBI). Despite successfully clearing the written examination and interview, the bank cancelled the offer after conducting a background check that revealed a low CIBIL score and a history of loan defaults.

The candidate challenged the decision in the Delhi High Court, arguing that their personal financial matters should not affect their professional opportunity, especially after clearing all the official selection stages.

However, the court dismissed the plea, stating that:

“A person who is financially undisciplined cannot be trusted with the responsibility of handling public funds. Banks have every right to ensure that their employees uphold financial integrity both professionally and personally.”

Why CIBIL Score Is Now a Hiring Criterion

This judgment has far-reaching implications. It officially links personal creditworthiness with professional suitability, especially for roles in the financial and banking sector. According to SBI and many other financial institutions:

-

Employees in banks deal with sensitive financial data and money handling.

-

An employee with a history of defaults, unpaid loans, or poor credit behaviour may pose a risk to the institution’s financial reputation and internal controls.

-

Hence, a background check that includes CIBIL score is not only justified but necessary.

This may set a precedent for all future public and private sector recruitments in the finance industry.

What Is a CIBIL Score, and Why Does It Matter So Much?

The CIBIL score, ranging from 300 to 900, is a numeric summary of a person’s credit history. A score above 750 is generally considered excellent, while anything below 600 raises red flags.

Banks use this score to assess:

-

Loan eligibility

-

Repayment behaviour

-

Financial discipline

-

Trustworthiness

Now, employers — particularly in finance — are treating CIBIL score as an indicator of character and decision-making ability.

Future Implications for Job Seekers

The court’s ruling indicates a possible shift in how background checks are conducted in India. Candidates applying for jobs in banking, NBFCs, insurance companies, and even fintech may soon face CIBIL verification as part of the recruitment process.

This makes it absolutely essential for job seekers to start taking their credit health seriously. While most candidates focus solely on competitive exams and interviews, they may be unaware that a poor credit record can silently sabotage their chances.

Lessons for Aspiring Bankers & Financial Professionals

If you’re planning to join the banking or financial industry, here are a few key takeaways:

-

Monitor Your Credit Score Regularly – Use free tools or visit CreditSamadhaan.com to check your CIBIL score regularly.

-

Avoid Loan Defaults – Even a minor default can reflect negatively and stay on your record for years.

-

Clear Past Dues – If you’ve had missed EMIs or credit card payments, clear them and request updates with the credit bureau.

-

Maintain Financial Discipline – Keep your credit utilization ratio low, avoid multiple loan applications, and build a good repayment track record.

Struggling with a Low CIBIL Score? Credit Samadhaan Can Help!

At Credit Samadhaan, we understand that not everyone has perfect credit — and life happens. Whether it’s due to job loss, medical emergencies, or unforeseen expenses, your credit score can take a hit. But that doesn’t mean your career should suffer too.

Our CIBIL score improvement experts offer:

-

Personalized credit repair strategies

-

Dispute resolution with credit bureaus

-

Guidance on settling or restructuring old debts

-

Regular monitoring and progress tracking

Take control of your credit before it controls your future.

📞 Contact Credit Samadhaan today or visit www.creditsamadhaan.com to speak to an expert and start your journey toward credit freedom and career success.

Stay informed with the latest updates in finance, careers, and credit only on CreditSamadhaan.com