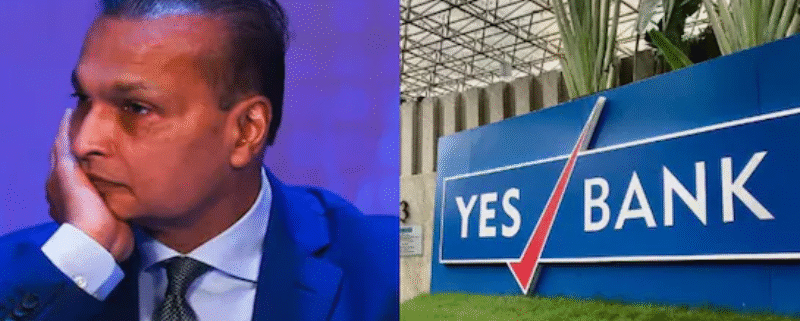

ED Raids Anil Ambani Group & Yes Bank in ₹3,000 Crore Loan Fraud Probe

Anil Ambani Group | In one of the most significant enforcement actions of the year, the Enforcement Directorate (ED) launched a sweeping operation on Thursday, July 24, 2025, targeting alleged financial irregularities involving Reliance Anil Dhirubhai Ambani Group (ADAG) and Yes Bank Ltd. The operation is linked to a suspected ₹3,000 crore loan fraud and potential violations under the Prevention of Money Laundering Act (PMLA), 2002.

Simultaneous Raids Conducted Across 35+ Locations

According to high-level ED sources, the raids began early Thursday morning and covered more than 35 locations in Mumbai and Delhi, including corporate offices, residences of senior executives, consultants, and intermediaries associated with both Reliance ADAG and Yes Bank. In total, over 50 companies and around 25 individuals are under active investigation.

These searches are part of a broader money laundering case that has evolved over several years, involving multiple agencies and a series of linked complaints.

Origin of the Probe: What Triggered the ED Investigation?

The ED’s investigation stems from at least two FIRs filed by the Central Bureau of Investigation (CBI), along with reports and alerts from key financial watchdogs, including:

-

National Housing Bank

-

Securities and Exchange Board of India (SEBI)

-

National Financial Reporting Authority (NFRA)

-

Bank of Baroda

These entities reportedly flagged questionable loan sanctioning practices, regulatory violations, and potential accounting misstatements involving several ADAG firms and Yes Bank during the 2017–2019 period.

The loans, estimated to total ₹3,000 crore, were allegedly issued to ADAG companies without proper credit appraisal or adherence to due diligence norms.

Suspicious Transaction Trail: Bribe-for-Loan Allegation

According to ED officials, there is prima facie evidence suggesting that Yes Bank promoters or executives may have received financial benefits — possibly bribes — through associated shell companies or personal concerns immediately before or after the loan approvals. This raises the suspicion of a quid pro quo arrangement in the loan sanctioning process.

In particular, the ED is probing:

-

Back-dated Credit Approval Memorandums (CAMs) created to justify high-risk loans

-

Violations of internal credit policy

-

Absence of risk assessment or due diligence on borrower companies

-

Loans sanctioned despite poor repayment capacity or deteriorating financials

Sources say that some funds were allegedly diverted to offshore accounts, routed through layered shell entities, or used to repay older liabilities in a circular funding mechanism, which qualifies as money laundering under PMLA provisions.

Companies Under the Scanner

While the ED has not officially named the full list of 50 entities, it is understood that the probe covers multiple ADAG subsidiaries, including:

-

Reliance Infrastructure

-

Reliance Power

-

Reliance Communications (RCom)

-

Reliance Capital

-

Reliance Naval & Engineering Ltd

Other consultancy firms, investment vehicles, and SPVs (special purpose vehicles) that handled transactions for both Reliance ADAG and Yes Bank are also under scrutiny.

Ongoing Legal Tussles: A Pattern of Financial Irregularities?

This isn’t the first time the Anil Ambani group has come under regulatory glare:

-

In 2020, Yes Bank’s then-promoter Rana Kapoor was arrested for money laundering involving dubious loan approvals.

-

Canara Bank had classified Anil Ambani’s group loan account as “fraudulent”, but later withdrew this classification in 2023 following a legal challenge in the Bombay High Court.

-

Just last month, Anil Ambani was fined ₹25,000 by the same court for seeking an urgent hearing in a tax dispute without following due procedure.

These developments reflect a pattern of financial distress, regulatory action, and legal pushback, suggesting deeper systemic issues within the group and its lending practices.

Impact on Financial System & Public Trust

This case is emblematic of India’s corporate lending crisis, where large borrowers obtain massive loans based on political clout, perceived market value, or personal relations rather than verified financial health.

Key Risks to the Ecosystem:

-

Banking Sector Exposure: Such loan frauds erode public trust in the banking and credit system. PSU banks and private lenders who participated in syndicated lending may now face higher NPAs and stress testing.

-

Credit Score Fallout: Individuals or MSMEs indirectly linked through suppliers, shareholders, or credit chains may face collateral damage to their CIBIL scores and loan eligibility.

-

Investor Confidence: Retail and institutional investors in ADAG companies are left vulnerable, especially with share prices likely to dip on news of raids and investigations.

-

Regulatory Tightening: This case may push RBI, SEBI, and NFRA to introduce stricter norms for loan disbursals, audit compliance, and board-level accountability.

What Happens Next?

According to officials familiar with the matter, the ED will now:

-

Examine digital and physical financial records seized during the raids

-

Issue summons to senior executives from Reliance ADAG and Yes Bank

-

Coordinate with foreign jurisdictions if evidence of offshore laundering emerges

-

Prepare for potential provisional attachment of assets

If evidence supports PMLA violations, formal arrests, asset freezes, and even prosecution under the Benami Transactions Act or Fugitive Economic Offenders Act may follow.

Credit Samadhaan’s Take:

“This is a defining moment in India’s fight against white-collar financial crime. High-profile cases like these not only demand enforcement but also long-overdue reforms in corporate governance, ethical lending, and credit accountability.”

We encourage every citizen to stay alert, monitor their credit profile, and seek professional help if you believe your financial exposure has been affected due to such frauds.

Further Reading on CreditSamadhaan.com

Follow the Story

Stay tuned to CreditSamadhaan.com for real-time updates, expert analysis, and exclusive interviews with banking and legal experts as this story unfolds.

Got a credit concern? Reach out to us for a confidential consultation.

📞 Contact Us | 📧 help@creditsamadhaan.com